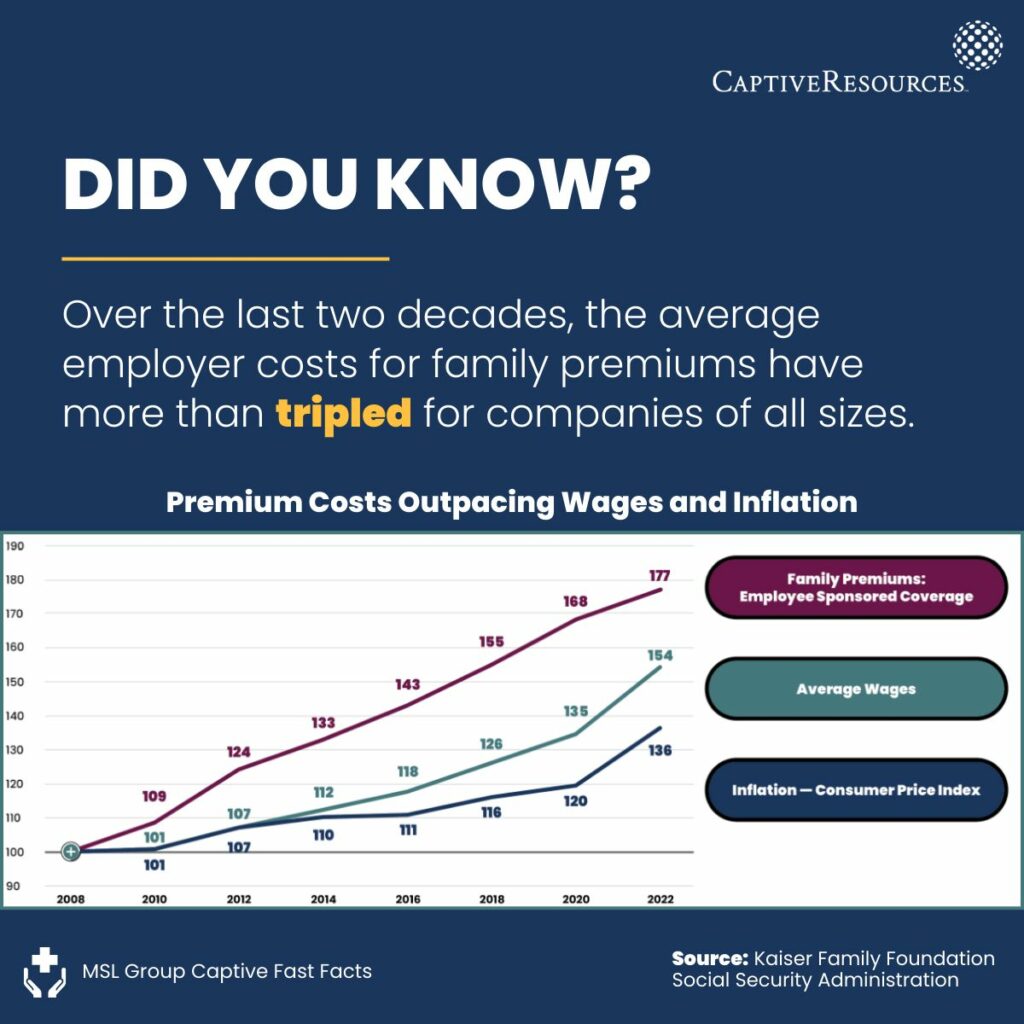

“Stop-loss carrier premium volume increased to $31.6 billion in 2022, reflecting a growth rate of 13.4% from 2017-2022, with 10% of the annual growth attributable to cost trends and business mix changes, and the remainder due to increased enrollment. However, claims increased at a faster rate, resulting in loss ratios deteriorating from 78.5% in 2017 to 84.1% in 2022.”12

The world of healthcare is evolving rapidly, and self-funded employers are increasingly turning to stop-loss insurance to protect themselves from catastrophic claims.

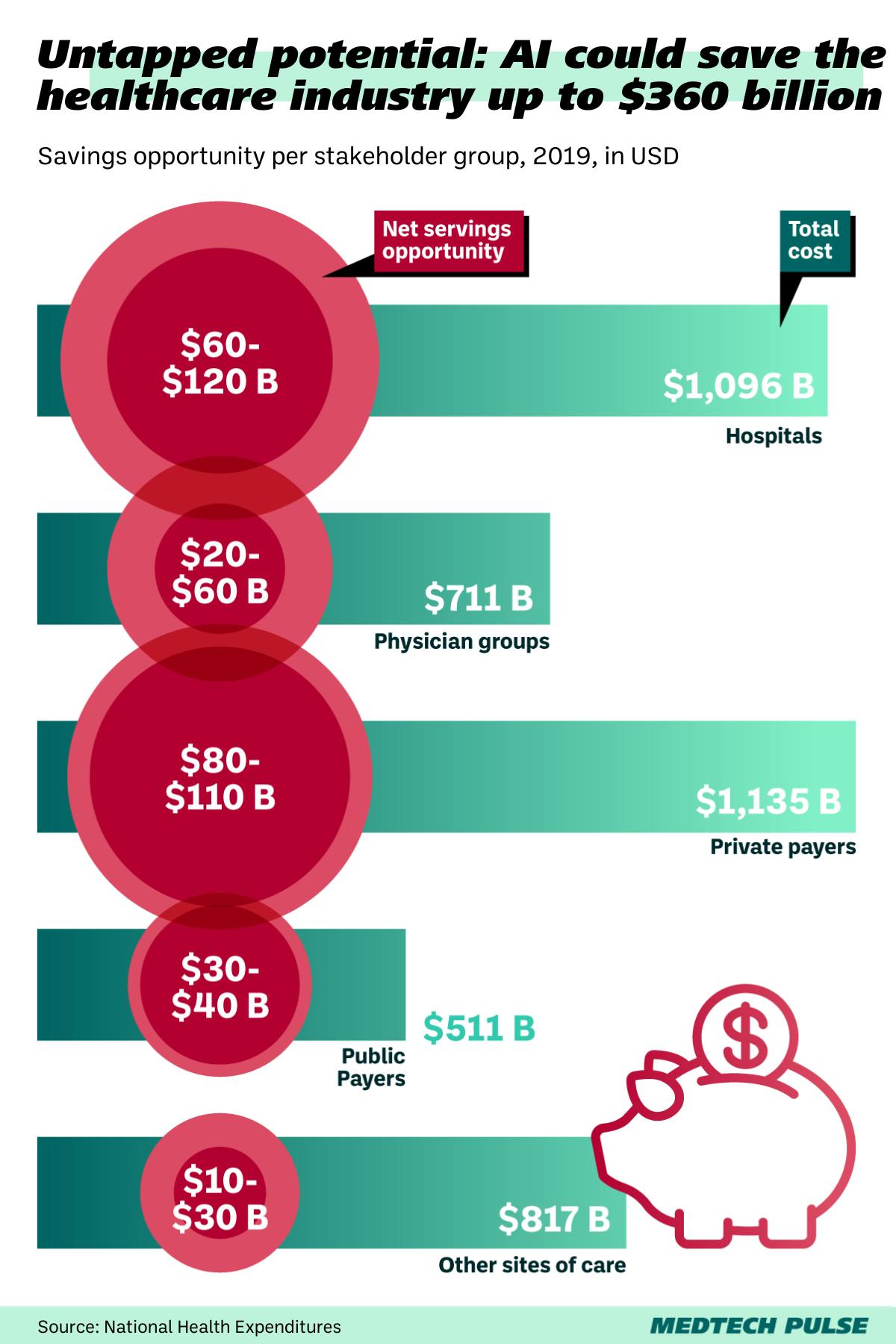

However, the traditional ways of assessing and pricing risk are no longer enough in an era of big data, artificial intelligence (AI), and predictive analytics. By leveraging these technologies, stop-loss insurance is undergoing a transformation that promises to make it more agile, efficient, and effective. This blog explores how predictive analytics is reshaping stop-loss insurance, the challenges it faces, and the exciting possibilities for the future.

What Is Stop-Loss Insurance?

Stop-loss insurance is a financial product designed to protect self-funded employers from excessive claims costs. Unlike traditional health insurance, where insurers assume all risk, self-funded employers pay for their employees’ healthcare claims directly. Stop-loss insurance acts as a safety net, reimbursing these employers for claims that exceed predetermined thresholds, thus capping their financial exposure.

Why Is Stop-Loss Insurance Important?

Stop-loss insurance serves as a critical tool for employers by:

- Providing Financial Protection:

It shields employers from unforeseen high-cost claims while enabling them to retain the benefits of a self-funded model. - Enhancing Budget Predictability:

By capping claim liabilities, it allows employers to forecast healthcare expenditures more accurately. - Supporting Self-Funding Viability:

Without stop-loss insurance, many organizations might avoid self-funding altogether due to potential catastrophic financial losses.

How Do Healthcare Payers Sell Stop-Loss Insurance?

Healthcare payers and insurance providers sell stop-loss insurance through brokers, consultants, and third-party administrators (TPAs). Here’s how the process typically unfolds:

- Market Segmentation:

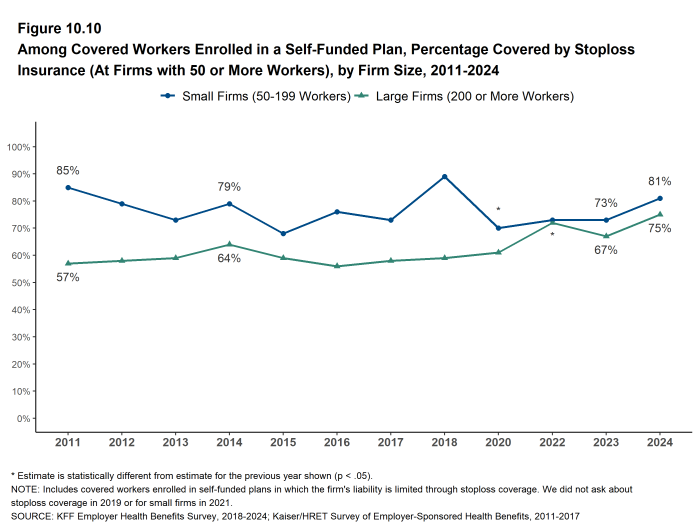

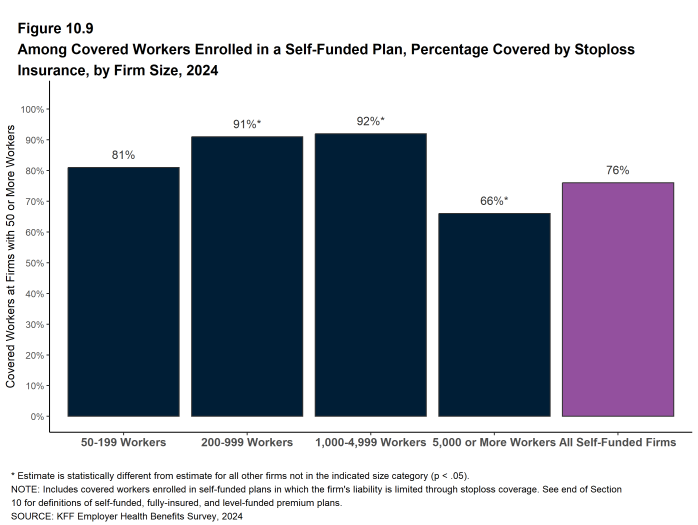

Payers target employers with self-funded health plans, emphasizing the need for financial safeguards against high-cost claims. An average of approximately 60% of private-sector workers have been enrolled in self-insured plans over the last 10 years, and there has been a notable uptick for smaller and medium-sized employers with fewer than 1,000 employees. Stop-loss premiums grew by 8% year over year in 2021, with the premium growth attributable to an increase in lives covered by stop-loss as more groups convert to self-funded medical plans from fully insured ones, coupled with rate increases.6 - Customized Coverage:

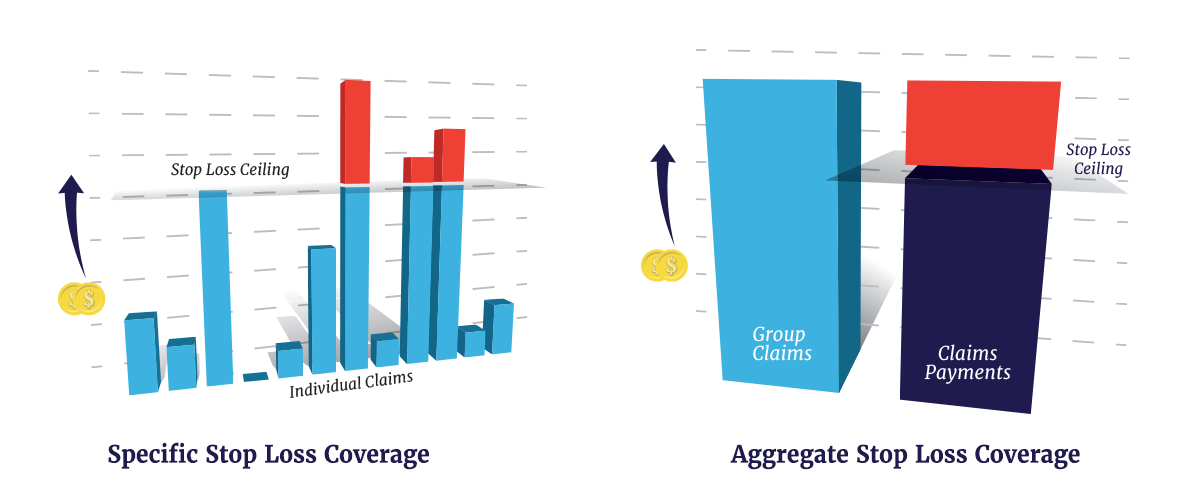

Policies are tailored to individual employer needs, offering either:- Specific Stop-Loss: Protection against high-cost claims from a single individual.

- Aggregate Stop-Loss: Coverage for claims exceeding a certain total amount across all members.

- Use of Data Analytics:

Insurers leverage data on workforce demographics, prior claims, and health trends to design optimal stop-loss coverage and pricing models.

How Is Stop-Loss Evolving?

In recent years, stop-loss insurance has seen a shift driven by:

- Predictive Analytics: Insurers are now using AI to assess risk and price policies dynamically.

- Integration with Digital Health Platforms: Real-time monitoring tools like wearables allow employers and insurers to predict and manage high-cost claims proactively.

For example, Sun Life Financial offers AI-enabled stop-loss solutions to help employers anticipate and plan for healthcare spending spikes. Similarly, Munich RE uses big data to enhance underwriting precision and competitiveness.

Key Metrics and Trends

- Adoption Rates: A significant portion of the U.S. workforce (approximately 65%) is covered under self-funded health plans, according to the Employee Benefit Research Institute.

- Market Growth: The global stop-loss insurance market is expected to grow at a CAGR of 6%–8% over the next decade, fueled by increasing adoption of self-funding among mid-sized employers.

Stop-loss insurance is no longer a static financial product; it is an evolving solution deeply intertwined with advancements in technology, predictive analytics, and employer demands for personalized healthcare strategies.

Current State of Predictive Analytics in Stop-Loss Insurance

Predictive analytics is revolutionizing how insurers assess risk and price policies. By analyzing historical claims data, public health trends, and even real-time inputs like wearable device data, insurers can better predict high-cost claimants and mitigate risks before they escalate.

Case Study 1: Sun Life Financial

Sun Life U.S. is the largest independent provider of medical stop-loss insurance in the country, covering self-funded employers against catastrophic healthcare claims. Their 2023 high-cost claims report highlighted:

- A 45% increase in million-dollar+ claims from 2019 to 2022, with the number rising from 109 claims per million members to 158 per million.

- High-cost injectable drugs (like gene therapies and biologics) represent a significant driver of these claims. For instance, treatments such as CAR T-cell therapy can cost upwards of $1 million per patient.

- Cancer treatments continue to dominate claim costs, constituting 31% of stop-loss claims over $1 million. The rise in precision medicine and innovative therapies is a contributing factor.

Introduction of AI-Powered Risk Stratification and Claims Management:

Sun Life utilizes advanced AI-driven analytics to optimize stop-loss underwriting and claims adjudication processes. Their platform employs predictive modeling to identify high-risk claims early, ensuring better cost management for employers.

Sun Life powers its Stop-Loss Benchmark with more than 2 million data points that are sourced from over 35,000 employer plan designs, approximately 21 million employee census records, and, through its unique partnership with Verisk Analytics, first-dollar claims representing $2.9 billion in medical costs. By tapping into this expansive data set along with reviewing Sun Life’s $2.1 billion in Stop-Loss reimbursements, the Stop-Loss Benchmark gives employers a holistic view of self-funding and stop-loss plans.11

Key differentiators include:

- Actionable Insights for Employers: With real-time dashboards powered by machine learning, Sun Life empowers employers with data transparency and tailored advice, reducing claim volatility.

- Early Detection of High-Cost Claims: Sun Life’s AI tools analyze patient health data to flag emerging risks like cancer treatments or gene therapies. For example, identifying potential high-cost claims like CAR T-cell therapy helps in preemptive planning.

- Fraud and Abuse Mitigation: AI algorithms reduce fraud-related payouts by scanning for anomalies in claims, saving employers significant costs.

Case Study 2: Munich RE

Munich RE, as a global reinsurer, provides risk management solutions to insurers, including stop-loss protection. Their focus on:

- Data-driven risk modeling: Leveraging predictive analytics to assess potential claim severity, enabling customized stop-loss solutions.

- A case study involving self-funded employers demonstrated that their tailored stop-loss solutions helped lower risk exposure, emphasizing the value of smart underwriting and reinsurer expertise in controlling costs.

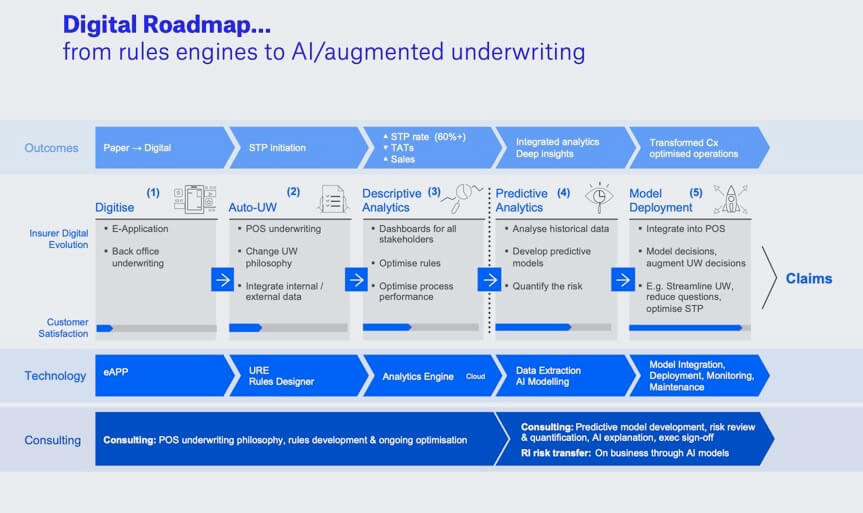

Their AI-augmented underwriting solution is designed to address prevalent industry challenges by leveraging AI and data to improve the customer experience, operational efficiency, risk selection, and sales and profitability for life and health insurers.

At its heart is Predictor, a cloud-based AI platform that enables secure, compliant data flows and the development, deployment, monitoring, management, and continuous maintenance of AI models embedded in the underwriting or claims process. It is integrated with Munich RE’s ALLFINANZ SPARK and NOVA underwriting solutions.13

Munich RE offers reinsurance on policies underwritten by these AI models as an optional service.

Additionally, Munich Re supports the adoption of value-based healthcare models to align costs with outcomes. For example, partnerships with healthcare providers on outcome-based pricing mechanisms can help lower catastrophic claims

Challenges in Implementing Predictive Analytics in Stop-Loss

Despite its potential, the adoption of predictive analytics in stop-loss insurance is not without challenges:

- Data Quality and Accessibility:

Insurers often face fragmented or incomplete datasets, leading to suboptimal predictions. Many organizations lack the infrastructure to collect and share standardized data. - Regulatory and Ethical Concerns:

The use of personal health data raises concerns about privacy and compliance, particularly with frameworks like HIPAA in the US and GDPR in Europe. - Resistance to Change:

Many insurers still rely on legacy systems, which are ill-equipped to handle the data requirements of predictive analytics. Resistance from stakeholders can further slow adoption.

The Future of Stop-Loss Insurance

As predictive analytics matures, its impact on stop-loss insurance will expand in several ways:

- Integration with Digital Health Platforms:

Insurers will increasingly use real-time health data from wearables and electronic health records to refine risk assessments and personalize coverage. - AI-Driven Dynamic Pricing:

Policies will be priced dynamically based on ongoing claims behavior, enabling insurers to offer more competitive and customized solutions. - Blockchain for Claims Transparency:

Blockchain technology will play a critical role in streamlining claims validation and reducing fraud, fostering trust between insurers and employers.

Speculative Forecasts:

- Within 5 years, mid-market and large enterprises are expected to adopt predictive analytics extensively, leading to a projected compound annual growth rate (CAGR) of 6–8% for the stop-loss market.

- In 10 years, AI-powered automation could adjudicate claims and process payouts in hours instead of weeks, making stop-loss insurance more efficient and appealing.

Global Implications and Market Growth

The global stop-loss insurance market is poised for significant change as predictive analytics and AI become integral to operations.

- Cross-Border Data Collaborations:

International partnerships will enable insurers to leverage diverse datasets, improving risk-sharing models for multinational employers. - Supply Chain and Dependence Shifts:

Innovations in stop-loss insurance will influence global healthcare supply chains, driving demand for integrated solutions that span borders.

Projections for the stop-loss market suggest continued growth, with adoption accelerating in regions with high self-funding rates like North America, Europe, and parts of Asia.

Conclusion

Predictive analytics is not merely a tool but a transformative force in the stop-loss insurance landscape. By addressing current challenges and investing in emerging technologies, insurers can unlock new possibilities and redefine the industry’s future.

For employers, the message is clear: those who embrace data-sharing initiatives and AI-driven insights will gain a competitive edge. For insurers, the time to invest in predictive models and next-generation technologies is now. The future of stop-loss insurance lies at the intersection of agility, technology, and global collaboration.

References:

- https://www.oliverwyman.com/our-expertise/insights/2023/nov/key-stop-loss-market-drivers-trends-2023.html ↩︎

- https://www.oliverwyman.com/content/dam/oliver-wyman/v2/publications/2023/nov/stop-loss-newsletter-fall2023.pdf ↩︎

- https://contingencies.org/u-s-health-employer-stop-loss-considerations-for-new-and-established-entrants/ ↩︎

- https://www.youtube.com/watch?v=vWKGvvJv1CY ↩︎

- https://fastercapital.com/content/Mitigating-Health-Care-Costs–Exploring-Aggregate-Stop-Loss-Insurance.html ↩︎

- https://news.ambest.com/newscontent.aspx?refnum=249292 ↩︎

- https://varipro.com/what-is-stop-loss-insurance/ ↩︎

- https://www.kff.org/report-section/ehbs-2024-section-10-plan-funding/ ↩︎

- https://www.kff.org/report-section/ehbs-2024-section-10-plan-funding/ ↩︎

- https://media-s3-us-east-1.ceros.com/sun-life/images/2024/05/15/4cfabc898aa1ddf9e7fee516e3a8383d/2024-hccr-de.PNG ↩︎

- https://www.prnewswire.com/news-releases/sun-life-financial-introduces-stop-loss-benchmark-expands-its-data-analytics-capabilities-536265231.html ↩︎

- https://www.linkedin.com/pulse/ai-insurance-2024-case-munich-re-ancileo-bfn2c/ ↩︎

- https://www.munichre.com/automation-solutions/en/resources/blog/next-generation-augmented-underwriting.html ↩︎

- https://www.the-digital-insurer.com/wp-content/uploads/2021/02/Munich-Re-Feb-2021-featured-report.jpeg ↩︎

- https://www.researchgate.net/publication/359014403_Mapping_of_clinical_research_on_artificial_intelligence_in_the_treatment_of_cancer_and_the_challenges_and_opportunities_underpinning_its_integration_in_the_European_Union_health_sector?_tp=eyJjb250ZXh0Ijp7ImZpcnN0UGFnZSI6Il9kaXJlY3QiLCJwYWdlIjoiX2RpcmVjdCJ9fQ ↩︎

- https://www.medtechpulse.com/article/infographic/ai-could-save-the-healthcare-industry-up-to-360-billion-a-year ↩︎

- https://www.captiveresources.com/insight/medical-stop-loss-group-captive-fast-facts-recap/ ↩︎

Leave a reply to Parijat Dutta Cancel reply